Rising Imports: Latin America’s Synthetic Boom and Vermouth Shift

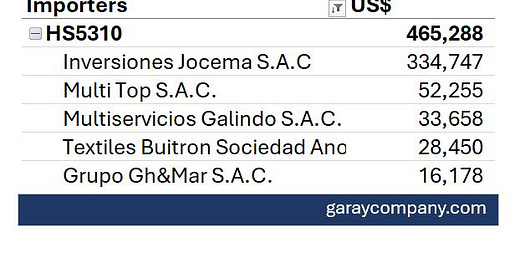

Peru’s Jute Fabrics Import Market Dominated by a Single Giant

The hessian jute fabrics (HS5310) import market in Peru shows a clear leader. For January-August 2024, INVERSIONES JOCEMA SAC imported a massive $334.7K.

Trailing behind, Multitop brought in $52.3K, with Multiservicios Galindo following at $33.7K. Others like Textiles Buitron and Grupo Gh&Mar round out the list with much smaller shares.

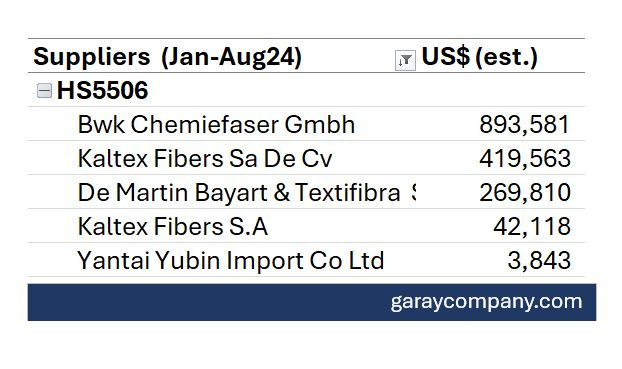

Main Suppliers of Synthetic Fibers to Peru

The synthetic fibers (HS5506) export market to Peru is led by BWK Chemiefaser Gmbh with $893.6K.

Other key suppliers include Grupo Kaltex with $419.6K and DE MARTINI BAYART & TEXTIFIBRA S.P.A. - DBT FIBRE S.P.A. at $269.8K.

Minor players like Grupo Kaltex and Lily Yantai contribute below $50K.

The Rise of Vermouth Imports in Latin America

As consumer preferences shift and the global interest in vermouth (HS 2205) grows, Latin America has seen a modest yet notable increase in imports. Though the region's role remains small in comparison to global import markets, Latin America is beginning to establish itself as an emerging player in vermouth imports.

Key Points:

- Slow but Steady Growth in Latin America:

Since 2004, Latin American vermouth imports have grown by 735%, increasing from $5.2M to $43.9M in 2023. Despite this significant growth, the region only accounts for 5% of global vermouth imports.

- Mexico and Brazil Lead the Market:

Mexico and Brazil have emerged as the largest vermouth importers in Latin America, with Mexico's imports rising from $1.1M in 2004 to $20.7M in 2023, an impressive growth of 1780%. Brazil followed closely, increasing its imports from $1.6M to $14.5M over the same period.

- Chile Shows Moderate Growth:

Chile has seen its vermouth imports rise from $240K in 2004 to $3.2M in 2023, marking a 1233% increase. Though smaller in absolute terms, Chile's growth reflects a broader trend of rising demand for vermouth across the region.

- Global Perspective:

Globally, vermouth imports have grown from $398M in 2004 to $853M in 2023. The global market has shown consistent expansion, driven by changing consumer preferences and the increasing popularity of craft cocktails and aperitifs.

Conclusion:

Latin America's vermouth market is growing steadily, led by Mexico and Brazil. Though the region still plays a minor role in the global market, there is significant potential for further growth. The increasing popularity of vermouth offers ongoing opportunities for importers across Latin America to strengthen their market presence.

Curious about the importers dominating your industry?

Get a tailored report on importers, US$ values, trends, who’s growing, who’s fading, and who’s emerging as the next big player. Let’s transform your business strategy today. Reach out:

Martin Garay

garaycompany.com

Linkedin

Whatsapp: +51992736260