Latin America’s Import Transformation: Net Gains and Woven Wins

The Latin American Seafood Surge:

Brazil Leads the Ocean Harvest Rush

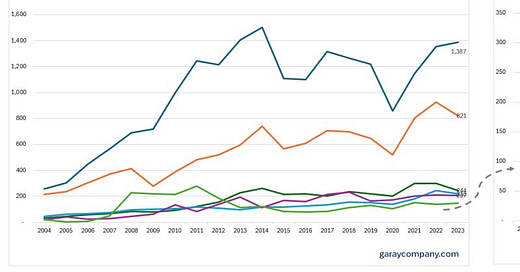

The evolution of HS03 (fish and seafood) imports in Latin America over the past two decades presents a compelling narrative of expanding seafood markets and changing consumption patterns.

Brazil's Market Leadership

- Brazil emerges as the undisputed regional leader, with imports growing from US$256 million in 2004 to US$1.39 billion in 2023, a remarkable 442% increase.

- The country experienced its peak in 2014 at US$1.5 billion, demonstrating the market's maturity and resilience.

- Brazil's dominance reflects its growing middle class and increasing sophistication in seafood consumption.

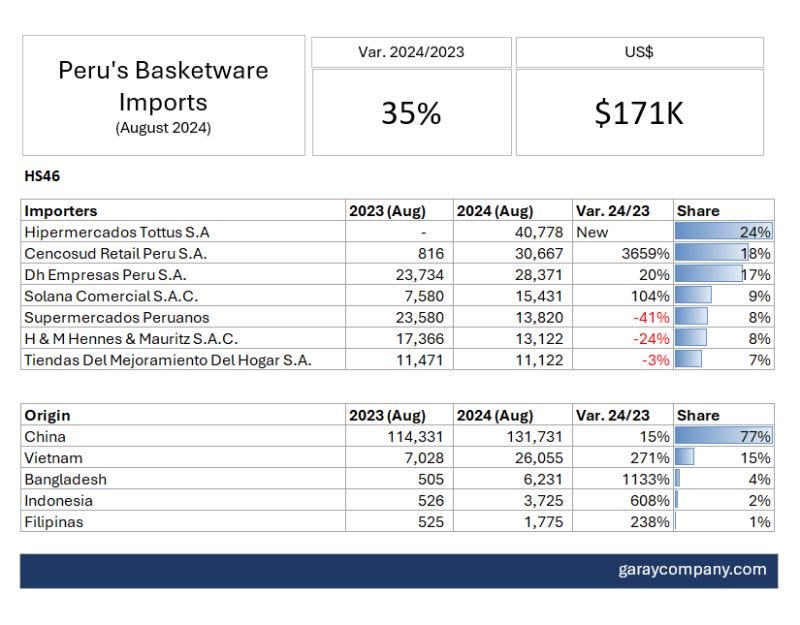

Peru’s Basketware Imports Skyrocket by 35% in August 2024: The Surge You Didn't See Coming

In August 2024, Peru’s basketware imports under HS46 surged by 35% compared to the previous year, reaching $171K.

Tottus, a new player in the sector, made a bold entrance, importing $41K worth of basketware, instantly grabbing a commanding 24% share of the market. Meanwhile, Cencosud S.A. made waves, with imports skyrocketing by 3659%, totaling $31K and claiming 18% of the share. DH Empresas Peru (Casaideas) also enjoyed a healthy 20% increase, securing $28,371 in imports.

On the flip side, not all players saw growth. Supermercados Peruanos S.A. faced a significant drop of 41%, while H&M experienced a 24% decline in imports.

Now, let's talk origins. China still reigns supreme, providing 77% of Peru's basketware imports with a 15% increase in value from 2023 to 2024.

But don’t overlook the fast risers—Vietnam catapulted its exports to Peru by 271%, while Bangladesh posted an astonishing 1133% growth, positioning itself as a small but rapidly growing supplier.

Indonesia and the Philippines also saw notable increases of 608% and 238%, respectively.

What’s your take on this significant shift in basketware imports? Could your industry benefit from this growth, or does it pose new challenges?

The Latin American Seafood Surge:

Mexico's Steady Climb

- Mexico shows a more moderate but consistent growth pattern, rising from US$213 million to US$821 million (285% increase).

- Notable spikes occurred in 2011-2012 (US$482 million) and 2022 (US$927 million), suggesting cyclical market behavior.

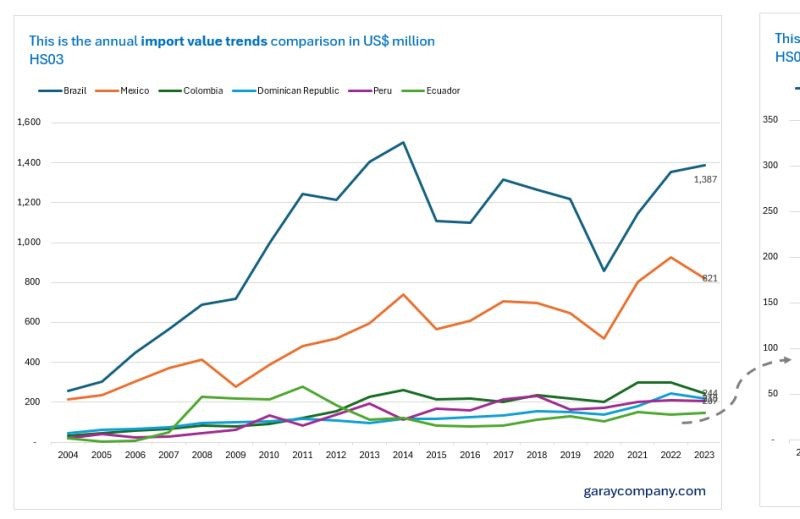

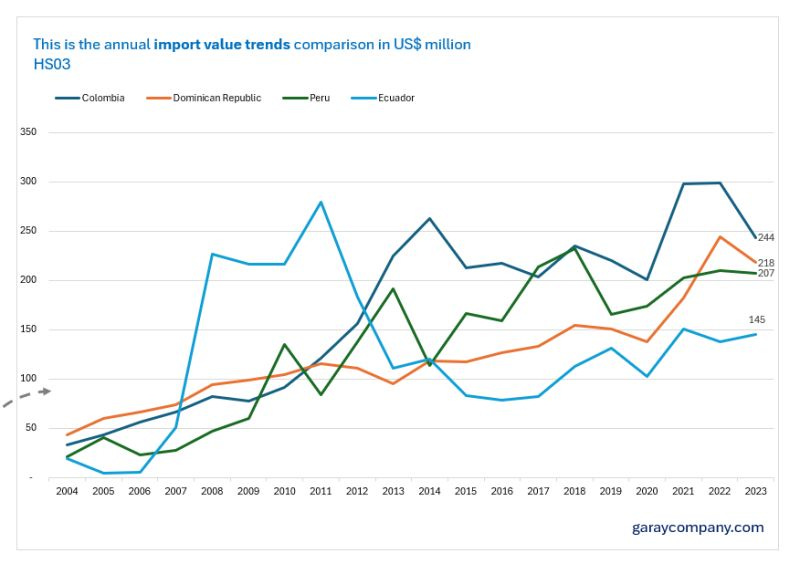

The Andean Evolution

- Colombia presents an impressive growth story, increasing from US$33 million to US$244 million (639% growth).

- Peru's transformation is equally notable, moving from US$21 million to US$207 million (886% increase), while Ecuador shows the most dramatic percentage growth, leaping from US$19 million to US$145 million (663% increase).

Curious about the importers dominating your industry?

Get a tailored report on importers, US$ values, trends, who’s growing, who’s fading, and who’s emerging as the next big player. Let’s transform your business strategy today. Reach out:

Martin Garay

garaycompany.com

Linkedin

Whatsapp: +51992736260