Latin America has seen significant shifts in its import patterns for flour (HS 11) over the past two decades.

This analysis highlights key trends, annual variations, and opportunities for exporters looking to tap into these markets.

Below, we break down the data for the top importing countries in the region.

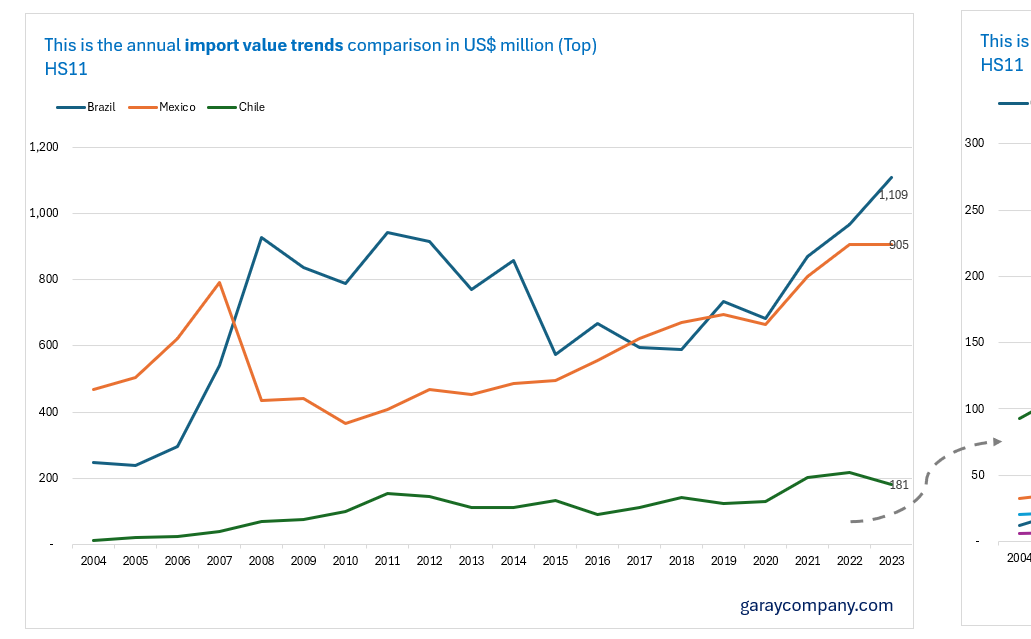

Brazil: A Flour Powerhouse on the Rise

Brazil has consistently been one of the largest importers of flour in Latin America.

Over the last 20 years, its imports have grown significantly, from $249 million in 2004 to an impressive $1.1 billion in 2023.

Notably, Brazil experienced a sharp increase of 15% from 2022 to 2023, marking one of the largest year-on-year growth rates in recent years.

This growth underscores Brazil’s expanding demand for flour, likely driven by its robust food processing industry and growing population.

Exporters should note that while Brazil’s imports dipped slightly in 2015 and 2017, the market rebounded strongly from 2018 onward.

The steady upward trajectory since then makes Brazil a stable and lucrative market for flour exporters.

Mexico: A Consistent Giant with Steady Growth

Mexico ranks as another dominant importer, starting at $469 million in 2004 and reaching $905 million in 2023.

While its growth has been less dramatic than Brazil’s, Mexico has shown resilience and steady increases over time.

A significant jump occurred between 2019 and 2020, when imports rose by 14%, from $694 million to $810 million.

The Mexican market is characterized by consistent demand, making it a reliable destination for exporters.

Its proximity to major flour-producing countries also facilitates trade logistics, further solidifying its position as a key player in the region.

Chile: A Market of Gradual Expansion

Chile’s flour imports have grown steadily over the years, starting at just $13 million in 2004 and reaching $181 million in 2023.

One standout period was between 2011 and 2012, when imports surged by 54%, jumping from $100 million to $154 million.

Another notable increase occurred between 2021 and 2022, with a growth rate of 53%.

Chile’s relatively smaller market size compared to Brazil or Mexico may seem less attractive at first glance.

However, its consistent growth signals untapped potential for exporters willing to invest in long-term partnerships.

Guatemala: Small but Growing Steadily

Guatemala has emerged as a growing market for flour imports, increasing from $33 million in 2004 to $166 million in 2023.

The country saw a significant rise between 2018 and 2019, with imports increasing by 33%, from $83 million to $111 million.

While Guatemala remains a smaller player compared to larger economies like Brazil or Mexico, its steady growth trajectory makes it an attractive market for exporters targeting Central America.

Venezuela: A Volatile but Recovering Market

Venezuela’s flour import trends have been marked by volatility due to economic challenges.

Imports peaked at $198 million in 2008 before declining sharply in subsequent years.

However, recent data shows signs of recovery, with imports rising by 16% from 2022 to 2023, reaching $155 million.

Exporters should approach Venezuela cautiously but remain open to opportunities as the market stabilizes. Its recovery could signal renewed demand in the coming years.

Peru: A Stable Performer with Moderate Growth

Peru’s flour imports have grown moderately over two decades, increasing from $20 million in 2004 to $105 million in 2023.

A notable period of growth occurred between 2019 and 2020, when imports rose by 31%, from $67 million to $88 million.

While Peru’s market size is smaller than others on this list, its stable growth offers consistent opportunities for exporters looking for reliable partners.

Colombia: Emerging as a Key Player

Colombia’s flour imports have shown remarkable growth over time, starting at just $6 million in 2004 and reaching $100 million in 2023.

The most significant jump occurred between 2018 and 2019, with a staggering increase of 56%, from $41 million to $64 million.

Colombia’s rapid growth highlights its potential as an emerging market for flour exports.

Exporters should prioritize this country as it continues on its upward trajectory.

Key Takeaways for Exporters

Focus on Brazil and Mexico: These two countries dominate Latin America’s flour import market and offer stable demand.

Watch Emerging Markets: Countries like Colombia and Guatemala are growing rapidly and present untapped potential.

Adapt to Volatility: Markets like Venezuela may be risky but could yield high rewards during periods of recovery.

Leverage Regional Trends: Steady growth across most countries signals increasing demand for flour products region-wide.

Latin America offers diverse opportunities for flour exporters, ranging from large-scale markets like Brazil to emerging players like Colombia.

By understanding these trends and tailoring strategies accordingly, exporters can position themselves effectively to capitalize on this growing demand.

NEW: Unlocking 500+ flour importers in Latin America 2023-2024.

This full report (PDF report, dashboard and dataset in Excel included) contains what your competitors don't have access to:

Complete trade data of 500+ active importing companies in Latin America.

Detailed analysis of source markets

Monthly import trends and price variations

Comprehensive volume and value data

Year-over-year comparisons for 2023-2024

Strategic insights into market dynamics

Get your full copy NOW—reach out today and make it yours:

Martin Garay

Linkedin

Whatsapp: +51992736260

PS: Not in the flour industry? That’s ok. Let me know what product you want to export / import, and I’ll prepare a tailored report to your needs.